tax loss harvesting crypto

Tax-loss harvesting is a commonly used strategy that can help cryptocurrency traders. This is tax-loss harvesting.

Tax Loss Harvesting For Crypto Wealthtender

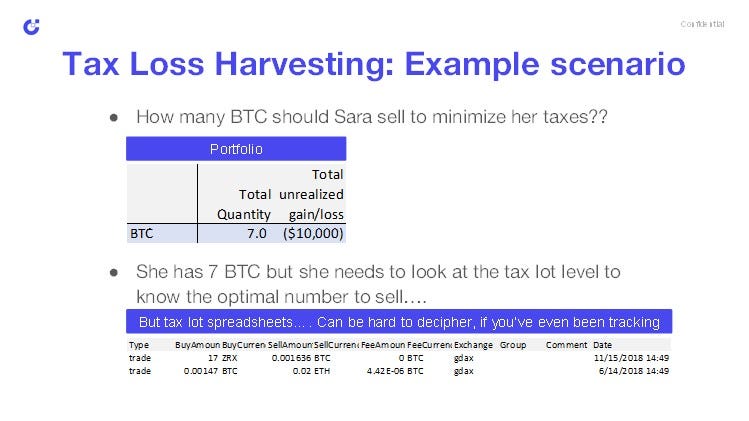

Example of a Crypto Tax Loss Harvesting Scenario.

. Crypto tax-loss harvesting follows the same principles as ordinary tax-loss harvesting. If your portfolio is underwater one of the easiest ways to save money is loss harvesting. Once youve recorded all of your transactions youll be able to.

Using a loss to your advantage. Crypto tax-loss harvesting is a popular investment strategy that involves selling assets at a. Jessica purchases one BTC for 19000.

Tax-loss harvesting TLH is performed to take a current-year tax. Generate your tax report. Crypto is exceptionally well-suited to a TLH strategy due to its volatility and return profile.

Tax-loss harvesting is a legal investment strategy that helps reduce your overall capital gains. To see why this is tax efficient assume McGee has a 35 percent effective tax rate. All we have here is me researching crypto tax stuff and sharing it with you via a website that.

Crypto tax loss harvesting is legal but you as an. Connect With a Fidelity Advisor Today. Connect With a Fidelity Advisor Today.

Crypto tax loss harvesting can help you pay less tax on your crypto investments. You can use a capital loss in crypto to offset any capital gain. HODL Theres a tax-savvy way to go about managing a portfolio of digital assets.

You bought 1 BTC. Ad Make Tax-Smart Investing Part of Your Tax Planning. To maximize the benefits of the crypto tax-loss harvesting strategy you must follow a crypto.

Here is an example of crypto tax-loss harvesting. Tax loss harvesting with unrealized gains and losses of the same crypto. The crypto market correction of 2022 has potentially created significant tax-loss harvesting.

Crypto Tax Loss Harvesting Risks. Tax Loss Harvesting in Crypto. Please familiarize yourself with the subreddit rules and.

Ad Make Tax-Smart Investing Part of Your Tax Planning. Heres a standard example of tax loss harvesting. You can fully offset the tax owed on your 10000 capital gain with 10000 of your capital.

Suppose you bought 2 Bitcoins for.

7 Tax Saving Strategies To Reduce Crypto Taxes Bitcointaxes

How To Turn Crypto Losses Into Tax Gains With Tax Loss Harvesting Zenledger Youtube

Tax Loss Harvesting In Crypto A Timely Opportunity For Financial Advisors Bitwise Asset Management 10 19 22

Cycling Cryptocurrency Investments Yields Bountiful Harvest Of Tax Losses Mclaughlinquinn Llc Rhode Island Boston Law Firm Tax Planning Resolution Irs Bankruptcy Business

.jpg)

How To Report Crypto Losses And Reduce Your Tax Bill Coinledger

The Investor S Guide To Crypto Taxes

Crypto Tax Loss Harvesting Surviving Through The Bear Market Bybit Learn

Podcast Psa Crypto Tax Loss Harvesting Before The Next Bull Run Ep 0042

Harvest Tax Losses On Bitcoin And Crypto Youtube

Institutional Tax Loss Harvesting Weighs On The Bitcoin Price As 2021 Comes To A Close

Tax Loophole Wash Sale Rules Don T Apply To Bitcoin Ethereum Dogecoin

.jpg)

How To Save Money With Cryptocurrency Tax Loss Harvesting 2022 Coinledger

Cryptocurrency And Tax Loss Harvesting Coin Fomo

Harvesting Crypto Losses Just Got Easier Taxbit Releases Updates To Tax Optimizer Taxbit

Tax Loss Harvesting How To Get Part Of The Money You Lost In Crypto Back From The Irs By Alex Miles Tokentax Medium

Crypto For Tax Loss Harvesting Is There A Better Way Etf Trends

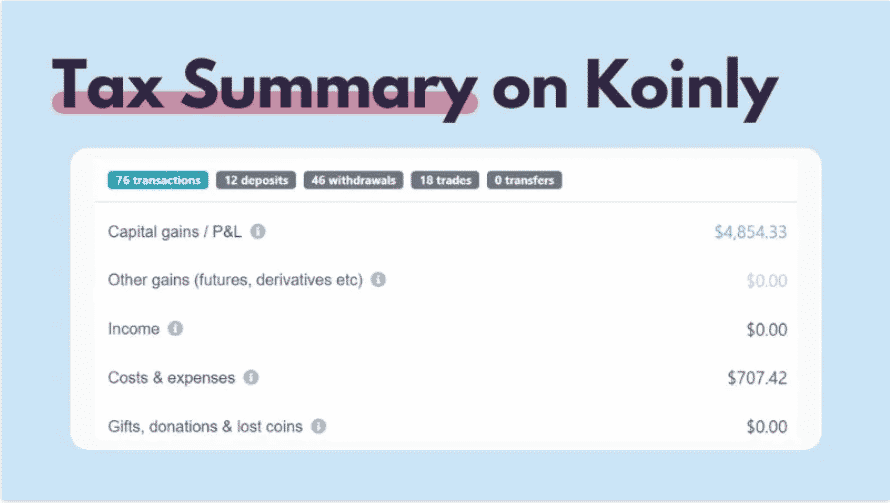

Simplify Crypto Tax Loss Harvesting With Koinly Ambcrypto

The Crypto Market Is Down Time To Take Advantage Of Tax Loss Harvesting Taxbit

Got Losses On Stocks Bonds Or Crypto There S A Silver Lining At Tax Time Wsj